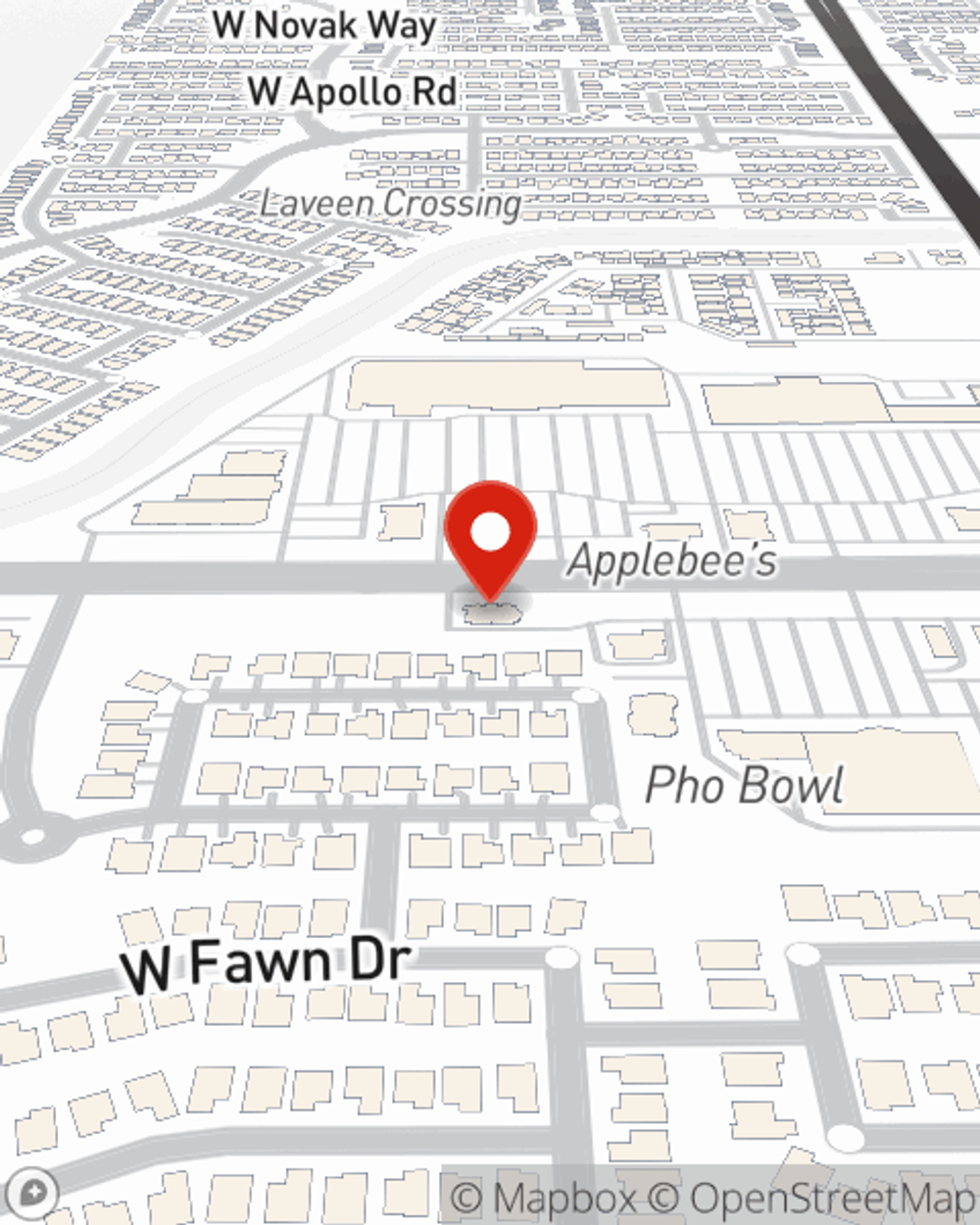

Business Insurance in and around Laveen

One of Laveen’s top choices for small business insurance.

Cover all the bases for your small business

Your Search For Remarkable Small Business Insurance Ends Now.

You've put a lot of energy into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a confectionary, a lawn care service, a pharmacy, or other.

One of Laveen’s top choices for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

Your business thrives off your passion commitment, and having dependable coverage with State Farm. While you make decisions for the future of your business and support your customers, let State Farm do their part in supporting you with commercial auto policies, artisan and service contractors policies and worker’s compensation.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Derrick Spencer's team to review the options specifically available to you!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Derrick Spencer

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.